- Vermont, Cayman license more than half of the quarter’s new captives

- Healthcare sector contributes largest proportion of Q2 formations

- United States’ domiciles home to two thirds of new captives in 2025

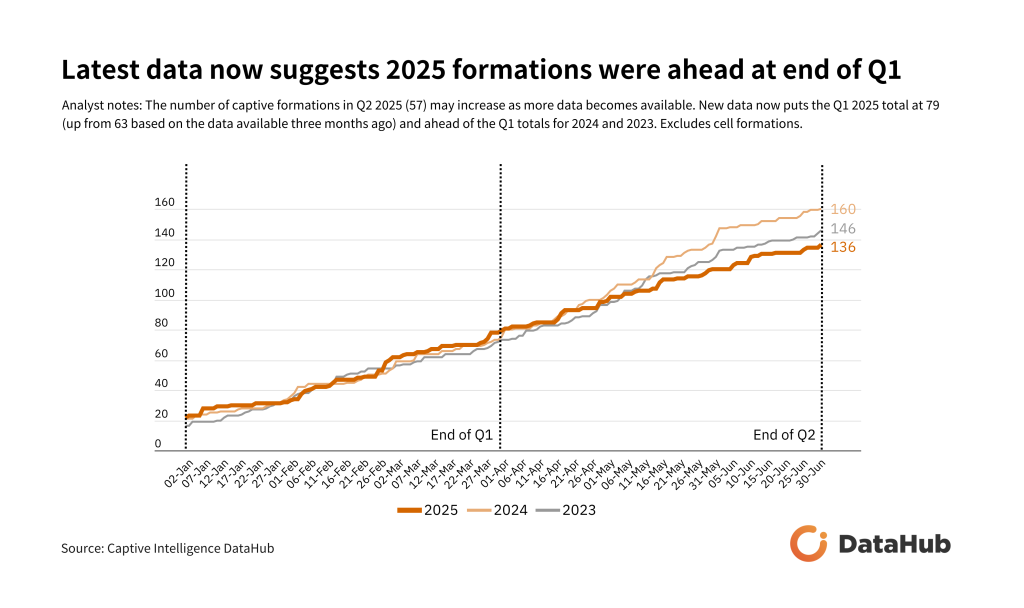

- Revised figures show Q1 formations in 2025 ahead of ‘23 and ‘24

A flurry of captive formations from the healthcare sector has 2025 on track for a strong chance to match or beat new licence numbers of recent years.

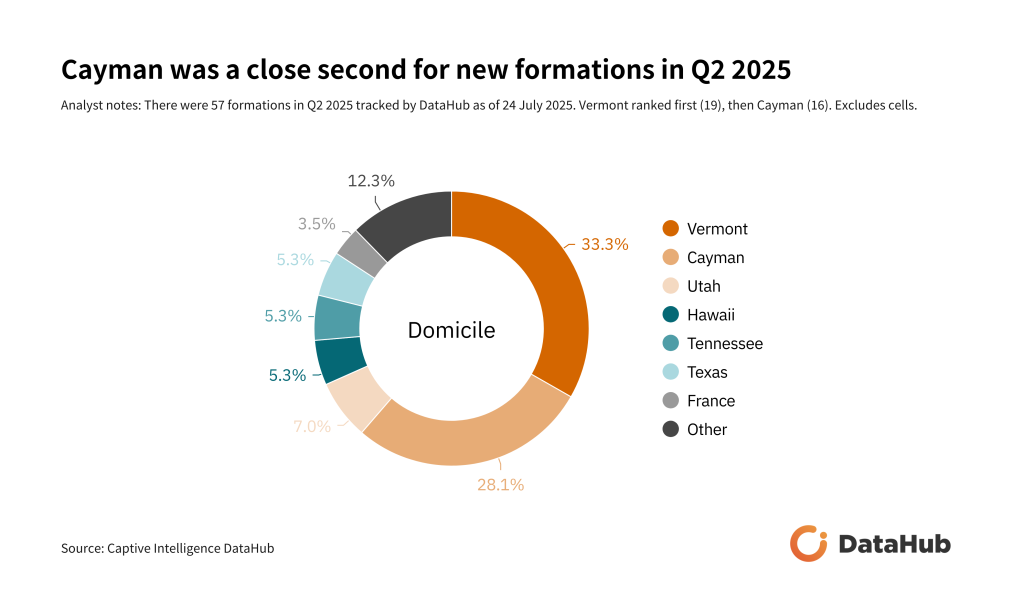

In our second quarterly DataHub update, we share insights from the 57 new captives formed in Q2 across the 52 domiciles we are actively tracking.

We reported in May that 63 new captives had been formed in Q1 with this number now revised up to 79 since further licences were published.

This new data puts 2025 ahead of both 2024 and 2023 at the first quarter mark, and while the Q2 numbers lag behind at this moment, these are likely to see an increase too.

Healthcare’s captive love-in

While Real Estate was the standout sector for new formations in the first three months of the year, Healthcare, an ever-reliable contributor of captive business particularly in the United States, has been the big contributor to new formations in Q2.

The sector now accounts for 11.7% of new formations in 2025, behind Insurance on 12.7% and just ahead of Real Estate (9.6%).

Among those healthcare organisations forming captives in the second quarter were San Diego-based Scripps Health, the San Juan Regional Medical Center and the Kentucky-headquartered Graves-Gilbert Clinic.

If you are not a subscriber to Ci DataHub and would like more information on these captives, including when they were licensed, where they are domiciled and who manages them, request a demo by emailing Lucy.

While Cayman is expected to lead the charge on healthcare captives, to date in 2025 Vermont and Cayman have each licensed four, while others have been formed in Arizona, Hawaii and Washington DC.

Vermont, Cayman bring the volume

Across formations of all captive types and sectors, Vermont led the way in the second quarter with 19 new licences issued, followed closely by Cayman with 16.

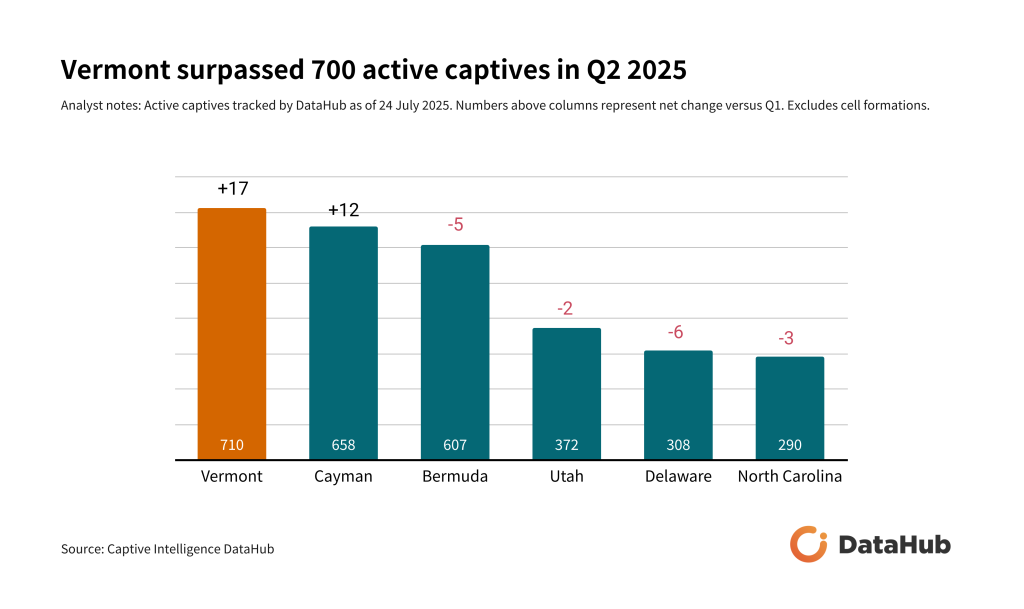

Vermont also crossed the 700 active captive mark after a net addition of 17, having had two captives surrender licences during the quarter.

The industry sectors forming captives in Vermont reflect the global trend too, with Real Estate and Healthcare leading the way among new formations in the world’s leading domicile in 2025.

Domiciles across the United States have licensed 65.7% of the new captives formed in the first half of 2025, followed by Bermuda and the Caribbean jurisdictions with 19.7%.

Formations across Europe, including the EU domiciles and offshore centres such as Guernsey, lag behind with 10.9%.

While France has attracted much of the attention for new captive business since 2023, it is Luxembourg that has got off to a relative flyer this year with seven new captives licensed in the first half of 2025.

Companies from France (two), Germany (two), Belgium (two) and Spain (one) have chosen the Grand Duchy to domicile their captive emphasising the continued demand for specialist captive centres.

In Asia in 2025, three captives have been formed – one each in Singapore, Hong Kong and Labuan.

Established managers keep their share

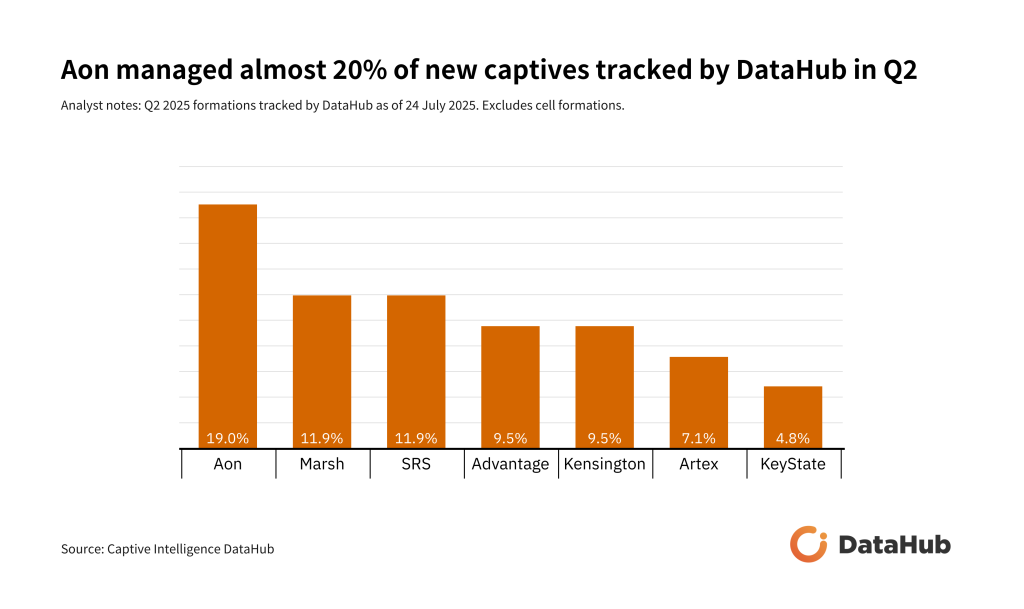

The captive management landscape, particularly in the US, remains diverse.

While we continue to see consolidation, with the recent news Brown & Brown has agreed to acquire Accession Risk Management Group, Inc, meaning captive managers Oxford Risk Management Group and Risk Management Advisors will soon be part of a much larger group, new players continue to make their mark.

Broker-owned giants Marsh and Aon do lead the way on new formations, however, with Aon contributing almost 20% of new Q2 2025 captives tracked by DataHub.

Across the entire first half of 2025, Marsh leads the way managing 14.4% of new captives, with Aon and Strategic Risk Solutions each on 12.4%.

To dig deeper into who is forming captives, where they are domiciled and who is managing them, request a demo of Ci DataHub to find out more and subscribe.