Ian Davis to lead VCIA

Captives give greater visibility, control to international programmes

Involving a captive in an international programme can optimise structure and reduce the total cost of risk, if executed effectively, according to Jelto Borgmann and Kerstin Kader, of HDI Global.

Speaking on the latest episode of the Global Captive Podcast Borgmann, head of captive services at HDI Global, and Kader, head of HGN technical accounting and intercompany at the multinational insurer, explained the complexity of international programmes, the challenges that need to be overcome and the important role captives can play in improving performance for the group.

Borgmann said businesses with global operations utilise international programmes to harmonise coverages and claims handing, while eliminating much of inconstancies when operating across multiple jurisdictions.

“Captives add an additional layer to it, because with the captive in place behind the international insurance programme, you also have the advantage that you gain greater visibility and control over the risk globally,” Borgmann added.

“And at the end you can decide with this data, for example, you collect from the captive to do risk mitigation measures and then ultimately reduce the total cost of risk.

The podcast discussion also covers currency fluctuations and premium transfer, and the importance of getting compliance right in every territory.

“From a compliance perspective, international programmes ensure that local policies meet the constantly changing regulatory requirements in each jurisdiction while captives provide a centralised risk management solution,” Kader said.

“And this dual approach optimises programme structure, streamlines processes everyone can rely on, and enhances overall transparency.”

Listen to the full international programmes discussion on the Global Captive Podcast here, or on any podcast app.

GCP Short: Achieving international programme success

In this GCP Short, produced in partnership with HDI Global, and we discuss international programmes and the important role captives play in facilitating them.

For multinational companies, it is common for a captive to play a role in the layers of an international programme, utilising one or more fronting partners to bring consistency across many, sometimes hundreds, of territories.

Richard is joined by Jelto Borgmann, Head of Captive Services at HDI Global, and Kerstin Kader, Head of HGN Technical Accounting and Intercompany, at the German multinational insurer.

Jelto and Kerstin discuss why international programmes are relevant for captives, how to overcome challenges and complexity such as currency fluctuations and premium transfer, and the importance of getting compliance right in every territory.

For all the latest news, data-driven analysis and thought leadership on the global captive market, visit Captive Intelligence and sign up to our twice-weekly newsletter.

Goodwin hires Christopher Pozzo as partner in financial services practice

SRG acquires Ecclesia’s Netherlands and Belgium businesses

Vermont, Cayman leading formations in another stellar 2025 – Ci DataHub

- Vermont, Cayman license more than half of the quarter’s new captives

- Healthcare sector contributes largest proportion of Q2 formations

- United States’ domiciles home to two thirds of new captives in 2025

- Revised figures show Q1 formations in 2025 ahead of ‘23 and ‘24

A flurry of captive formations from the healthcare sector has 2025 on track for a strong chance to match or beat new licence numbers of recent years.

In our second quarterly DataHub update, we share insights from the 57 new captives formed in Q2 across the 52 domiciles we are actively tracking.

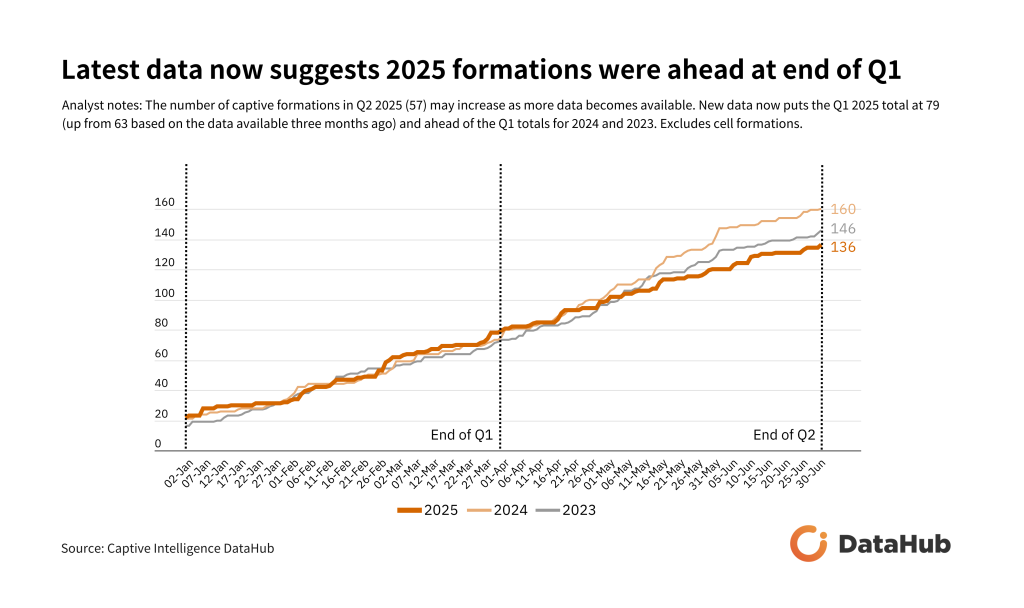

We reported in May that 63 new captives had been formed in Q1 with this number now revised up to 79 since further licences were published.

This new data puts 2025 ahead of both 2024 and 2023 at the first quarter mark, and while the Q2 numbers lag behind at this moment, these are likely to see an increase too.

Healthcare’s captive love-in

While Real Estate was the standout sector for new formations in the first three months of the year, Healthcare, an ever-reliable contributor of captive business particularly in the United States, has been the big contributor to new formations in Q2.

The sector now accounts for 11.7% of new formations in 2025, behind Insurance on 12.7% and just ahead of Real Estate (9.6%).

Among those healthcare organisations forming captives in the second quarter were San Diego-based Scripps Health, the San Juan Regional Medical Center and the Kentucky-headquartered Graves-Gilbert Clinic.

If you are not a subscriber to Ci DataHub and would like more information on these captives, including when they were licensed, where they are domiciled and who manages them, request a demo by emailing Lucy.

While Cayman is expected to lead the charge on healthcare captives, to date in 2025 Vermont and Cayman have each licensed four, while others have been formed in Arizona, Hawaii and Washington DC.

Vermont, Cayman bring the volume

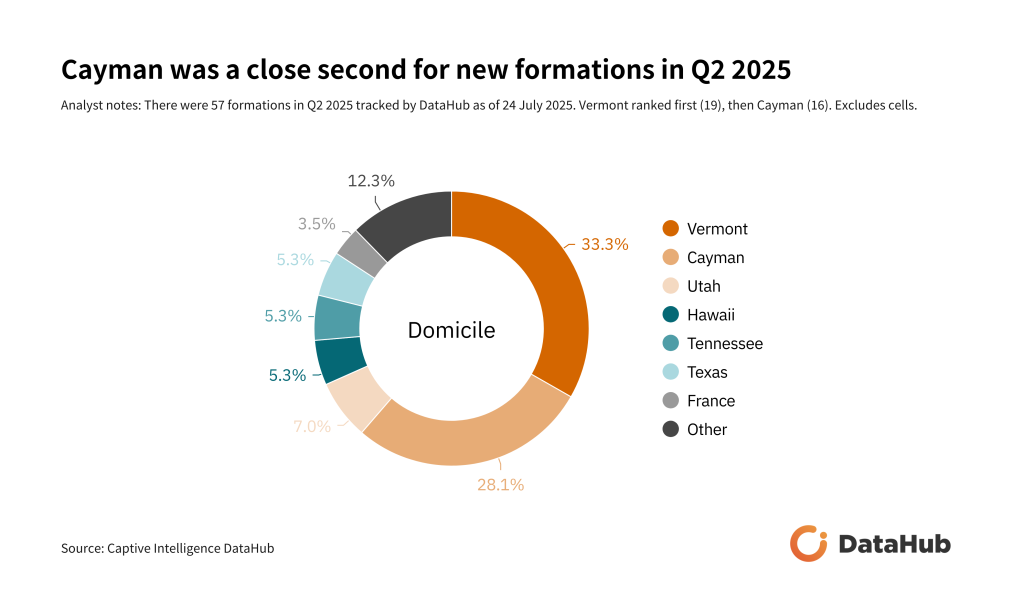

Across formations of all captive types and sectors, Vermont led the way in the second quarter with 19 new licences issued, followed closely by Cayman with 16.

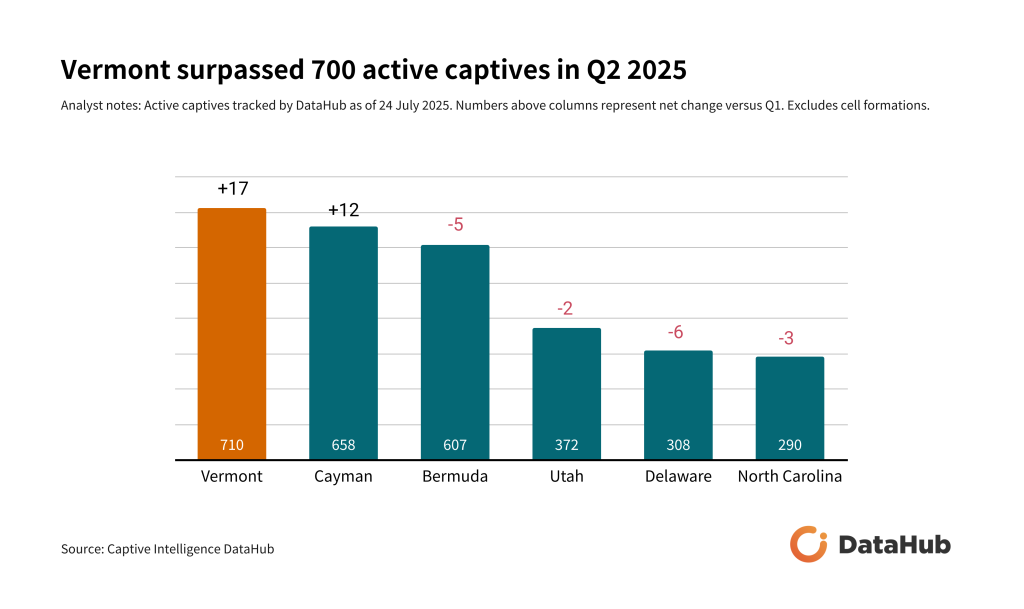

Vermont also crossed the 700 active captive mark after a net addition of 17, having had two captives surrender licences during the quarter.

The industry sectors forming captives in Vermont reflect the global trend too, with Real Estate and Healthcare leading the way among new formations in the world’s leading domicile in 2025.

Domiciles across the United States have licensed 65.7% of the new captives formed in the first half of 2025, followed by Bermuda and the Caribbean jurisdictions with 19.7%.

Formations across Europe, including the EU domiciles and offshore centres such as Guernsey, lag behind with 10.9%.

While France has attracted much of the attention for new captive business since 2023, it is Luxembourg that has got off to a relative flyer this year with seven new captives licensed in the first half of 2025.

Companies from France (two), Germany (two), Belgium (two) and Spain (one) have chosen the Grand Duchy to domicile their captive emphasising the continued demand for specialist captive centres.

In Asia in 2025, three captives have been formed – one each in Singapore, Hong Kong and Labuan.

Established managers keep their share

The captive management landscape, particularly in the US, remains diverse.

While we continue to see consolidation, with the recent news Brown & Brown has agreed to acquire Accession Risk Management Group, Inc, meaning captive managers Oxford Risk Management Group and Risk Management Advisors will soon be part of a much larger group, new players continue to make their mark.

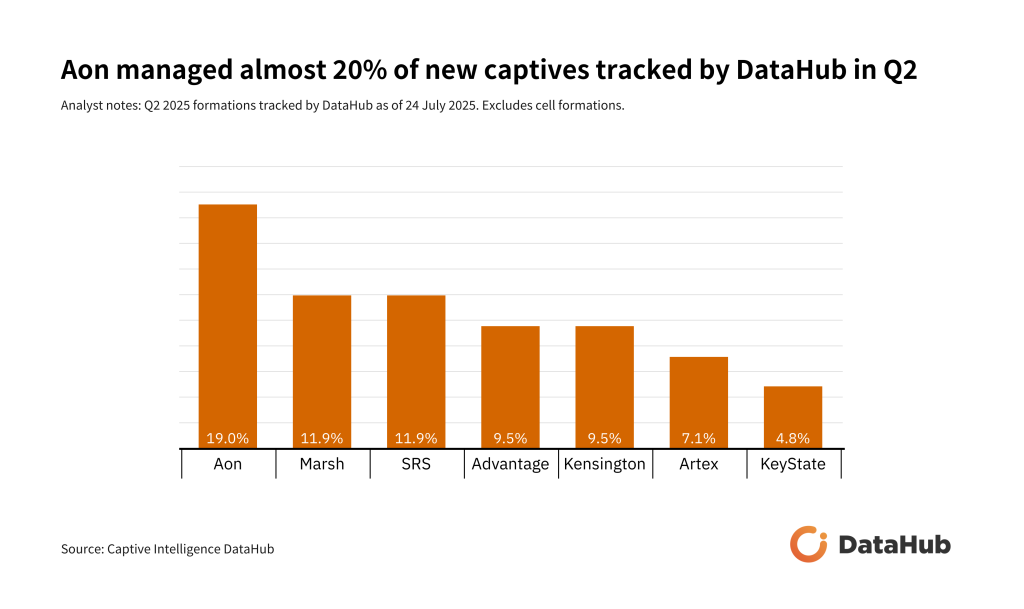

Broker-owned giants Marsh and Aon do lead the way on new formations, however, with Aon contributing almost 20% of new Q2 2025 captives tracked by DataHub.

Across the entire first half of 2025, Marsh leads the way managing 14.4% of new captives, with Aon and Strategic Risk Solutions each on 12.4%.

To dig deeper into who is forming captives, where they are domiciled and who is managing them, request a demo of Ci DataHub to find out more and subscribe.

Propriety Insurance partner Grid151 on title insurance for real estate captives

US brokers forced into group captive embrace, accelerates growth

The group captive concept has become so popular in the United States that more brokers and sub brokers are having to set up their own alternative offering to avoid being left behind, according to Rob Collins, captive segment leader and managing director at Guy Carpenter.

Speaking on the latest episode of the Global Captive Podcast alongside Linda Johnson, executive vice president and chief underwriting officer at Old Republic Risk Management, Collins explained what had been driving booming group captive utilisation in recent years.

“The growth in group captives is driven by the insured; the business owner’s desire to control their insurance costs and outcomes,” Collins said.

“Thirty-five to 40 years ago, this product was new to the market and was really only available to the largest buyers, the most sophisticated buyers.

“Now that’s not the case any longer. The idea of controlling your insurance outcome by commitment to safety and being able to have a stable, reliable product – it’s not always the cheapest product, but it’s something that provides tailored, customised coverages and has consistent pricing over the long term, and I think that’s really attractive to any risk manager or any CFO.”

Johnson pointed out that another area of significant growth for group captives has been the expansion into new lines of insurance, away from the traditional high frequency, low severity profiles.

“Now, in this marketplace, you are starting to see coverages that are much more severity driven, which is creating a new dynamic within the group captive market,” she said.

“We’re finding because of the sophistication of the captive consultants and the customers that are coming into this marketplace, that severity driven risks can equally be handled within the group captive models, which I find really fascinating. You wouldn’t have convinced me 30 years ago that that was a good place for them to be.”

The barrier to entry for group captive members has also been steadily decreasing, while the range in size of insurance buyers participating is broadening.

“We see many companies that are spending as low as $75,000 or a $100,000 on their casualty insurance programmes going into group captives,” Collins added.

“They’re doing that because the barriers to entry are very low these days. The capital contribution from them is relatively small, so they can leverage the stability of a group.

“If you have 50, or 100 or 300 members in a group captive, there’s a lot of stability and buying power that comes with that that they can tap into immediately with a pretty low barrier of entry from a capital perspective. Same with collateral; the collateral can be spread out and be manageable over a period of time.”

Guy Carpenter works with group captives on reinsurance buying and legacy solutions, while Old Republic provides fronting services to the growing marketplace.

Collins observed that the increasingly mainstream nature of group captives is only going to accelerate as more brokers spot the opportunity while seeing clients move into the strategy – with or without them.

The danger for brokers not embracing group captives is that they are left behind.

“The large captive managers that have driven the growth and product development within group captives over the last 30 to 40 years, they’ve relied on a pretty broad distribution network of brokers to feed business into their groups,” Collins added.

“What we’re seeing now, which is a little bit of a shift, is those other brokers, sub brokers, starting their own group captive division.

“So they’re looking to try to capture that business and control it themselves within their own agency or broker network, which is a different wrinkle. That just speaks to the fact that every broker needs to have an alternative solution for their customers, and if they don’t, they will either be left behind or be sharing their revenue – which is obviously precious to them – with other brokers and so I think that that will continue to fuel growth as well.

“We’re seeing new startups and we’re getting calls all the time from some of the brokers that have just been sub brokers in this space now looking to control that element of solution for their clients.”

Listen to the full episode and discussion on group captives on the Global Captive Podcast here, or on any podcast app. Just search for ‘Global Captive Podcast’.