AM Best assigns rating to Mondelez International captive

Subscribe to Ci Premium to continue reading

Captive Intelligence provides high-value information, industry analysis, exclusive interviews and business intelligence tools to professionals in the captive insurance market.

Global Captive Management launches Outcomes SPC

Subscribe to Ci Premium to continue reading

Captive Intelligence provides high-value information, industry analysis, exclusive interviews and business intelligence tools to professionals in the captive insurance market.

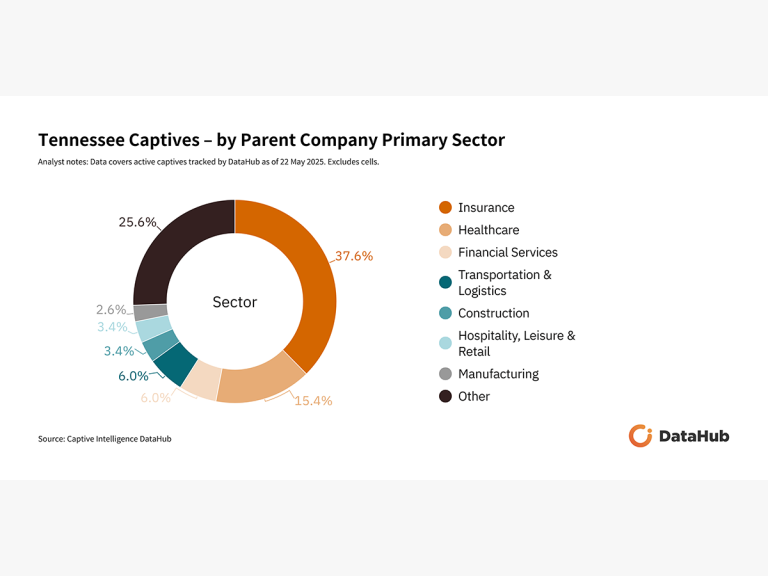

Domicile Wars: Business friendly environment and ‘yes’ attitude key to Tennessee growth

Subscribe to Ci Premium to continue reading

Captive Intelligence provides high-value information, industry analysis, exclusive interviews and business intelligence tools to professionals in the captive insurance market.

VCIA launches AI-powered captive insurance knowledge assistant

Subscribe to Ci Premium to continue reading

Captive Intelligence provides high-value information, industry analysis, exclusive interviews and business intelligence tools to professionals in the captive insurance market.

Generali Employee Benefits partners with Unum Limited

Subscribe to Ci Premium to continue reading

Captive Intelligence provides high-value information, industry analysis, exclusive interviews and business intelligence tools to professionals in the captive insurance market.

Vermont Governor signs H.137 into law, updates captive statute

Subscribe to Ci Premium to continue reading

Captive Intelligence provides high-value information, industry analysis, exclusive interviews and business intelligence tools to professionals in the captive insurance market.

Georgia passes House Bill 348, expands lines of business authorised

Subscribe to Ci Premium to continue reading

Captive Intelligence provides high-value information, industry analysis, exclusive interviews and business intelligence tools to professionals in the captive insurance market.

Tennessee licences 8 pure captives, 28 cells so far in 2025

Subscribe to Ci Premium to continue reading

Captive Intelligence provides high-value information, industry analysis, exclusive interviews and business intelligence tools to professionals in the captive insurance market.

HDI Global SE appoints Phil McDowell as global sales and distribution lead

Subscribe to Ci Premium to continue reading

Captive Intelligence provides high-value information, industry analysis, exclusive interviews and business intelligence tools to professionals in the captive insurance market.